Sustainable Investing History

In a balanced, carefully written memo, White House Advisor Daniel Patrick Moynihan informed President Nixon that the burning of fossil fuels was increasing the amount of carbon dioxide in the atmosphere. By raising the temperature of the planet, this increase could lead to a massive rise in sea level, inundating…

Read More

The Interfaith Center on Corporate Responsibility (ICCR) was founded in 1971 by lawyer Paul Neuhauser to oppose apartheid in South Africa. Neuhauser wrote a shareholder proposal for General Motors on behalf of the Episcopal Church, calling on GM to withdraw business from South Africa until apartheid was abolished.

The UNEP was established in Stockholm, Sweden, at the UN Conference on the Human Environment.

The Global Sullivan Principles were created to promote corporate social responsibility among companies doing business in apartheid South Africa. Reverend Leon Sullivan aimed to use the principles to exert pressure on South Africa to eliminate the apartheid system.

The Brundtland Report defined and popularized the term “sustainable development” as “development that meets the needs of the present without copromising the ability of future generations to meet their own needs”.

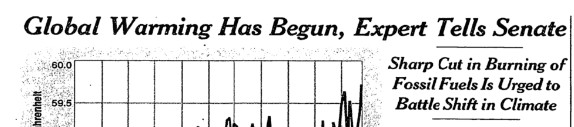

NASA Scientist James Hansen told the US Senate that global warming was underway. He projected the global temperature increases to come from burning fossil fuels and urged that action be taken to reduce fossil fuel use. This was reported on the front page of the NY Times the next day…

Read More

The Intergovernmental Panel on Climate Change (IPCC) held its inaugural meeting in November 1988. The IPCC was established by the United Nations Environment Programme (UNEP) and the World Meteorological Organization (WMO). It was charged with providing ongoing assessments of: the state of scientific knowledge and information on climate change the…

Read More

In the wake of the Exxon Valdez oil spill, Joan Bavaria gathered a group of investors and environmentalists to establish Ceres, the Coalition of Environmentally Responsible Economies.

KLD, a firm founded in Boston in 1989 by Peter Kinder, Steve Lydenberg and Amy Domini, launched the Domini 400 Social Index, the first capitalization-weighted index to track sustainable investments. The index is now the MSCI KLD 400 Social Index.

Representatives from 179 countries attended the UN Conference and Environment and Development – often referred to as the “Earth Summit” – to discuss global sustainability. Accomplishments of the Conference included: Agenda 21, calling for new strategies of investment to achieve overall sustainable development in the 21st century. The Rio Declaration…

Read More

ICGN was established as an investor-led network to promote “the highest standards of corporate governance and investor stewardship worldwide in pursuit of long-term value creation, contributing to sustainable economies, societies, and the environment”.

The GRI was established to ensure accountability to the Ceres Principles for responsible environmental conduct.

The Kyoto Protocol is an international treaty that extended the 1992 United Nations Framework Convention on Climate Change. Signatories to the Protocol committed to limit and reduce greenhouse gas emissions through targets individually set by each nation. The Protocol came into force in 2005. There are currently 192 signatories. In…

Read More

The GHG Protocol was created by the World Resources Institute and the World Business Council for Sustainable Development. It has created global standardized frameworks to measure and manage greenhouse gas (GHG) emissions from private and public sector operations and value chains .

Eight years after its signing, ratification of the Kyoto Protocol was completed, putting the treaty in force.

The report “A Legal Framework for the Integration of Environmental, Social and Governance Issues into Institutional Investments” was published by the Asset Management Group of the UN Enviromental Programme Finance Initiative (UNEPFI). The report permitted and encouraged ESG integration.

Seven Northeast states agreed to establish a mandatory cap & trade system covering emissions from the electric power sector. RGGI was the first such mandatory carbon market in the United States.

The Principles for Responsible Investment (PRI) was launched at the NY Stock Exchange. PRI was was created by group of institutional investors convened by the UN Secretary General in 2005.

The enactment of AB32 committed California to reduce GHG emissions to 1990 levels by 2020. The legislation empowered the California Air Resources Board to adopt regulations that would achieve “the maximum technologically feasible and cost-effective GHG emission reductions”. With this legislation, California was the first state to set legally-binding caps…

Read More

The first green bond, known as a climate awareness bond, was issued by the European Investment Bank.

The landmark American Clean Energy and Security Act, also known as the Waxman-Markey for its authors and sponsors, Henry Waxman (CA) and Ed Markey (MA), passed in the US House of Representatives. It was blocked and never voted on in the Senate. Had it been enacted, it would have established…

Read More

The principles and the publication of “Guidelines for Establishing the Green Financial System” paved the way for the development of green finance and ESG products in the Chinese market.

With the achievement of the 2020 GHG emissions targets set in 2006, SB32 adopted new targets, committing the state to reducing GHG emissions to 40% below 1990 levels by 2030.

Ceres and partners launched Climate Action 100+ as an investor-led initiative to engage with the corporations emitting the most greenhouse gases. The goal is to encourage those large emitters to take actions on climate change to mitigate financial risk and maximize the long-term value of their assets. Originally launched in…

Read More

THe Chinese government announced its intent to create a national emissions trading scheme to “limit and reduce” emissions in a “cost effective” manner. The system is to begin operation in 2021 and will initially cover emissions from coal and gas fired power plants. It is to be expanded to seven…

Read More

The Business Roundtable published “Purpose of a Corporation” which explicitly moved corporate purpose away from shareholder primacy to a multi-stakeholder view.

The total issuance of Green Bonds since their introduction in 2007 reached $1 trillion, as reported in a study by Bloomberg New Energy Finance (BNEF).

Recognizing that our society and economy depend on natural capital – nature’s assets and the services they provide – the TNFD was established to “provide companies and financial institutions with a risk management and disclosure framework to identify, assess, manage and, where appropriate, disclose nature-related issues”.

The VRF and CDSB will consolidate with the ISSB.

ISSB releases exposure drafts for two proposed initial standards to create a “comprehensive global baseline of sustainability-related disclosures designed to meet the information needs of investors in assessing enterprise value” S1 General Requirements for Disclosure of Sustainability-related Financial Information S2 Climate-related Disclosures ISSB announces that it plans to build on…

Read More

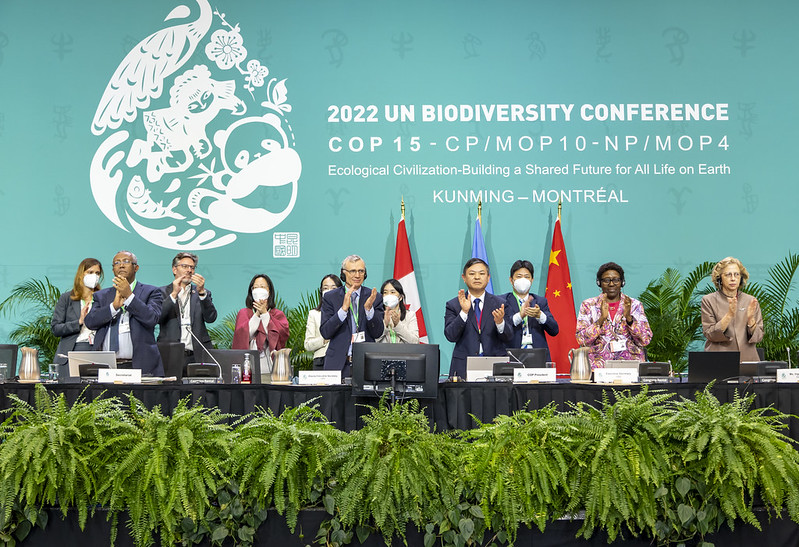

150 nations met for the United Nations Biodiversity Conference (COP 15) in Montreal, Canada. They agreed to set four goals and twenty-four 2030 targets to preserve, protect and rebuild global biodiversity, including: Protecting 30% of earth’s lands oceans, coastal areas & inland waters Reducing harmful annual government subsidies by $500…

Read More

The IPCC 6th assessment report on climate change clearly and unequivocally concludes that there are multiple, feasible and effective options to reduce greenhouse gas emissions and adapt to human-caused climate change. Cutting global GHG emissions by nearly half by 2030 is practical and achievable. Reducing emissions and implementing necessary adaptions…

Read More

In June 2023, the ISSB released finalized standards for sustainability and climate-related disclosures: General Sustainability-related Disclosure (S1) Climate-related Disclosures (S2) The standards became effective as of January 1, 2024.

The Task Force for Nature-related Financial Disclosures released its final standards. The TNFD disclosure framework consists of conceptual foundations for nature-related disclosures, a set of general requirements, a set of recommended disclosures structured around the four recommendation pillars of governance, strategy, risk and impact management, and metrics and targets.

The 28th Conference of the Parties in Dubai completed a first “global stocktake” of the world’s status and progress since the Paris accords. Recognizing that progress has been insufficient to reach the goal of keeping global warming below 1.5 degrees centrigrade, the concluding agreement called for countries to recommit to…

Read More

US investments in sustainable funds grew in 2025 despite strong political headwinds. Sustainable and ESG funds totaled $6.6 trillion in assets under management (AUM). This represents 11% of the $61.2 trillion US investment market. This is among the headline findings in the 2025 Sustainable Investing market is included in the…

Read More

The European Union reached a crossover point in power generation in 2025. For the year, wind & solar generated more electricity (30%) than all fossil fuels (29%). , the EU generated more power (30% of the total) from renewable energy (solar & wind) than it generate from fossil fuels (29%).…

Read More

<-- Differences from live timeline

story-content="short" - testing

-->