We designed the September 27th BSAS lunch session on ESG Integration to highlight a development that is further along than many in the investment community realize – the progress ESG is making towards incorporation in the mainstream.

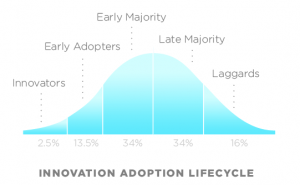

Putting it in the familiar terms of the technology adoption lifecycle model, our panelists’ presentations made a case that the integration of Environmental, Social and Governance factors is well along in the early adopter phase.

Noel Friedman, Vice President of ESG Business Development at MSCI, pointed to several trends driving integration.

- Asset owners are increasingly demanding ESG reporting and incorporation from their asset managers. Signatories to the UN Principles for Responsible Investment now represent $30 trillion in assets under management.

- Asset managers are increasingly seeing that ESG factors capture externalities that can represent mispriced risks and therefore opportunities.

Noel expanded on these opportunities with several examples using different industries, issues and metrics. He walked through identifying an ESG issue with potential impact on a specific industry, presenting data for analysis and drawing possible conclusions that could influence investment choices. Examples included:

- water management in the worldwide steel sector

- the impact of electricity cost increases on industrial gas manufacturers

- the implications of the wide range of the higher-risk loans/equity ratio among banks

- sensitivity to labor conflict in the airline industry

Michael Cantara, an Institutional Portfolio Manager and Co-Chairperson of MFS Responsible Investment Committee at MFS Investment Management, followed by picking up the themes of investor demand for and opportunity to create value with ESG integration.

Their conclusion is that long term value creation is consistent with many ESG principles. That led to a decision for a firm-wide integration of ESG considerations into the investment process. Rather than create a separate team of ESG specialists, ESG training and tools were provided to the entire investment team. Armed with that understanding, the teams themselves decide how to apply them. The integration is overseen by a firm-wide senior Rersponsible Investing Committee.

Michael followed that overview with several examples from their experience demonstrating how their investment teams incorporate ESG assessment as a component of their investment case. The examples considered a specific environmental, social or governance issue and the resultant impact on their investment case for a given company. There may be no change at all; in other examples the ESG factors led to a more positive investment case or removed a potential negative.

Taken together, the panel presentations and discussion provide evidence that demand for ESG integration is growing and investment managers are discovering competitive advantage by responding.

(The presentation materials from both panelists are available by request. Please contact me to be put in touch with either Noel or Michael.)